The Ultimate Guide To Financial Education

Wiki Article

5 Easy Facts About Financial Education Described

Table of ContentsGet This Report about Financial EducationA Biased View of Financial EducationThe Ultimate Guide To Financial EducationThe Best Strategy To Use For Financial EducationRumored Buzz on Financial EducationMore About Financial EducationSome Known Factual Statements About Financial Education

It is really hard to gauge the quantity as well as strength of individual finance instruction that is happening in people's houses, and also meaningful information on this subject is hard to acquire for the thousands of elementary as well as center institutions throughout the nation. Best Nursing Paper Writing Service. Definitive university information is equally difficult to locate around.In the section of this record qualified "Additional Credit rating: State Plans and also Programs That Are Making a Difference," we attempt to provide you a tiny tasting of the many state efforts that are attempting to bring individual money concepts to K-8 children as well as to young people in university or the office.

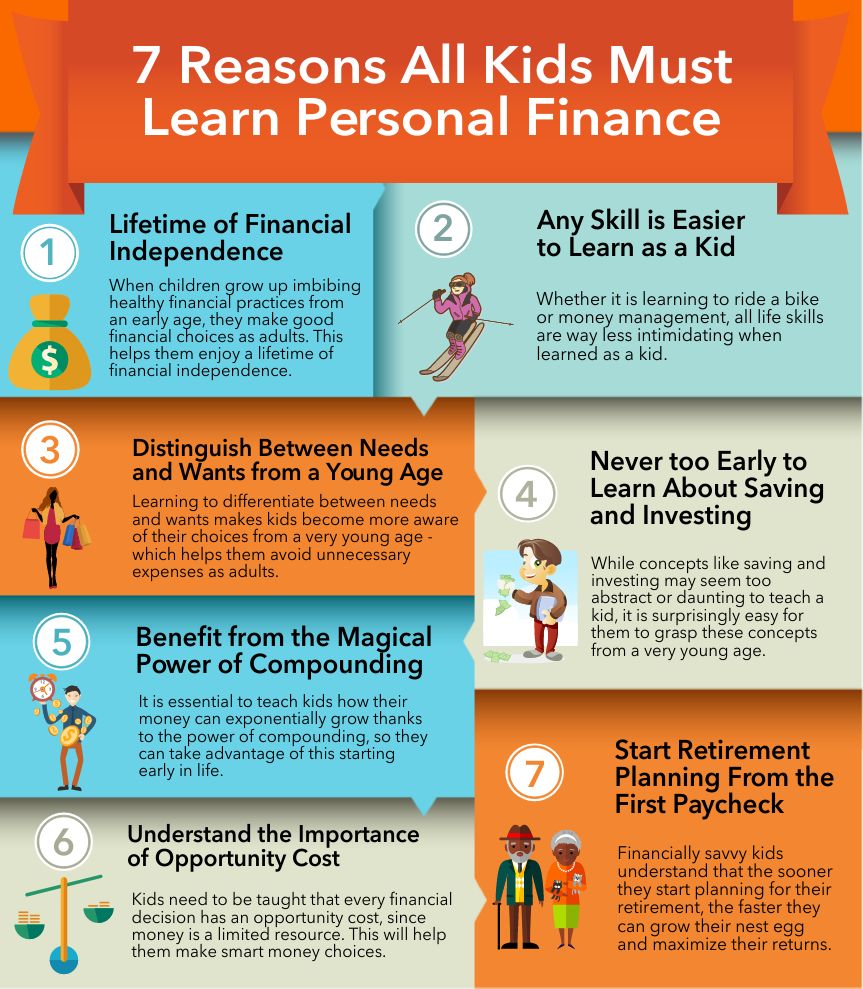

Kids are not discovering personal financing in your home. A 2017 T. Rowe Cost Survey noted that 69% of parents have some reluctance about discussing financial matters with their children. 3 As a matter of fact, moms and dads are almost as uneasy speaking to their kids about sex as they have to do with cash. Just 23% of youngsters checked indicated that they talk with their moms and dads often concerning money, as well as 35% stated that their parents are awkward talking with them regarding money.

Getting The Financial Education To Work

Having an exceptional credit report could conserve a customer in extra of a $100,000 in interest payments over a life time (see: 's Life time Expense of Debt Calculator). Financial proficiency causes much better personal money habits. There are a range of studies that show that individuals with higher degrees of financial proficiency make much better personal money choices.

It was found that mandated individual financing education and learning in secondary school enhanced the credit rating as well as reduced the default prices of young adults. There was no quantifiable modification in the surrounding states over the exact same amount of time determined. Another research study shows that a properly designed personal financing course (one semester in size), shown by extremely educated teachers that went to a 30-hour week-long training program and also utilized a details educational program, improved the typical individual financing expertise of the students in all typical as well as principle areas covered by the researchers' analysis examination (Asarta, Hillside, and also Meszaros, 2014).

The Best Guide To Financial Education

Pupils that received formal education by trained instructors reported some enhancement in many personal financing habits determined. Without a doubt, students who got personal financing education and learning by experienced teachers had "high economic proficiency" on the same level with the proficiency degrees of Generation X (ages 35 to 49) as well as greater than that of older Millennials (ages 18 to 34) (Champlain College's Center for Financial Literacy, 2015).We would not enable a young adult to enter the driver's seat of a cars and truck without calling for motorist's education, and yet we permit our young people to go into the complex economic globe with no related education and learning. An uneducated individual equipped with a credit rating card, a student loan and also access to a home mortgage can be almost as harmful to themselves and also their neighborhood as a person without any training behind the wheel of an automobile.

Throughout the Federal Reserve System, we function with the Jump$sharp Coalition-- in your area with the Washington, D.C., chapter and also through partnerships between the Book Banks and various other state chapters of the coalition-- to attain our shared objectives. The partnership in between the Federal Reserve as well as the Dive$tart Union is an all-natural one. Jump$sharp's mission to establish a more monetarily literate population supports the Federal Get's goal of a secure and growing economy.

Some Known Questions About Financial Education.

As pupils independently form homes or begin organizations, their cumulative choices will shape the economy of our future. I am particularly delighted to be able to stand for the Federal Book in this initiative as my individual dedication to economic proficiency has actually extended even more than three official site decades. I have actually been entailed with a variety of campaigns consisting of some that took me right into the class to show pupils straight as well as others that supplied teachers with tools as well as training to far better prepare them to educate business economics and also individual money.They require to understand exactly how to budget plan as well as save and how to select the best investment lorries for their financial savings. try here And also as the current monetary turmoil has actually educated us, they have to recognize exactly how to get ready for and deal with economic backups such as unemployment or unexpected expenses (Best Nursing Paper Writing Service). Leap$tart supports initiatives to supply such an education.

Along with giving products for monetary education, the Federal Get has also started to evaluate the effectiveness of the education and learning programs it participates in, so that we can much better assess the outcomes of our efforts. This research is planned to assist us better respond to the question, "What operates in education?" That we might assign our sources in the finest feasible way.

Financial Education Can Be Fun For Everyone

The Federal Get is the key government company billed with writing policies controling consumer financial products. Historically, we have actually concentrated on disclosure as the very best method to supply customers with information to choose in between items or to choose about using monetary items. In recent times, we have actually used comprehensive consumer screening to determine customers' understanding of financial disclosures and to highlight practices that just can not be comprehended by customers also with the most effective disclosures.Lately, the Federal Get has actually written strong new consumer protection rules for mortgages, charge card, and overdraft charges. And we have improved our response time for composing rules to attend important site to arising patterns that may position new dangers for consumers. In closing, I would love to thank the educators here today for your dedication to Washington-area pupils.

I am pleased to be a component of this discussion amongst the personal and public sectors, as well as the education and learning area, regarding exactly how best to empower pupils with the self-confidence as well as savvy to navigate their economic globes.

The Main Principles Of Financial Education

For more valuable ideas for company owner, follow Every, Revenue on Facebook, Twitter, as well as Linked, In.

How Financial Education can Save You Time, Stress, and Money.

By- Payal Jain, Founder as well as Chief Executive Officer, Funngro As a young adult, have you ever seen your parents reviewing something related to money, as well as when you attempt to join the conversation, they either switch over the topic or state something like "we are doing something vital, don't disturb". A lot of us ask yourself why they do this, why can not we understand concerning cash? Well, you are not exactly economically literate, so rather truthfully, they assume it would certainly be of no help at the moment.Report this wiki page